city of richmond property tax rate

Richmond City collects on average 105 of a propertys assessed fair market value as property tax. The budget calls for lowering the property tax rate from 0687772 to 068.

Why Choose Creg Fulshear Missouri City Texas Real Estate

Ahead of the fiscal year with starts Oct.

. 804 646-5686 1999-2022 City of Richmond Virginia. June 5 and Dec. All City of Richmond delinquent taxes 2018 and prior must be paid to the City of Richmond Collector prior to.

The adopted Tax Rate is set at 069990 cents per 100 valuation which is the same as last year. The total 2021 Millage Rates are 408378 for homestead and 587622 for non-homestead. Macomb County Homestead Tax Rate Comparisons.

Average Property Tax Rate in Richmond Based on latest data from the US Census Bureau Richmond Property Taxes Range. School Taxes 1-888-355-2700 Metro Vancouver 604-432-6200 Greater Vancouver Transportation Authority TransLink 604-953-3333. The total 2021 Millage Rates are 408378 for homestead and 587622 for non-homestead.

City of Richmond Property taxes Meanwhile a proposed casino that would have brought additional revenues to the City was rejected in a narrow vote by Richmond voters. When a Council Tax payer dies. The new assessments will be used to calculate tax bills mailed to city property owners next year.

The median property tax also known as real estate tax in Richmond city is 212600 per year based on a median home value of 20180000 and a median effective property tax rate of 105 of property value. Council Tax reminders and summonses. Electronic Check ACHEFT 095.

Parking Violations Online Payment. Any returns filed after May 1 st are assessed a late filing fee of ten dollars 10 or ten percent 10 of the tax assessed whichever is greater. Property Taxes Richmond CA - Official Website.

Admissions Lodging and Meals Taxes Online Payment. Problems paying your bill. Even though higher assessments.

How is the real estate tax assessment determined. Under state law if a municipalitys total property tax revenue exceeds that collected in the previous year by 1 due to assessment increases the. Richmond City has one of the highest median property taxes in the.

Assessment Methodology Individual property assessments are valued at 100 of the clean loan value. Average Property Tax Rate in Richmond Based on latest data from the US Census Bureau Richmond Property Taxes Range Based on latest data from the US Census Bureau You May Be Charged an Unfair Property Tax Amount Possibly you dont know that a real estate tax levy may be higher than it ought to be because of an unfair appraisal. City of Richmond adopted a tax rate City of Richmond City Hall 402 Morton Street Richmond TX 77469 281 342-5456 Website Design by Granicus - Connecting People and Government.

105 of home value. If you are considering taking up residence there or just planning to invest in the citys property youll come to understand whether the citys property tax laws are well suited for you or youd rather search for another place. June 5 and Dec.

Tax Rate per 100 of assessed value Albemarle County 434 296-5856. The real estate tax rate is 120 per 100 of the properties assessed value. Tax bills are mailed out on July 1st and December 1st and are due on September 30th and February 28th.

These agencies provide their required tax rates and the City collects the taxes on their behalf. 2021 Richmond Millage Rates. The Virginia Constitution requires that all assessments be at 100 of the fair market value FMV of the property.

1 the Richmond City Commission has adopted a 415 million budget. To view previous years Millage Rates for the City of Richmond please click here. 009 in addition to Hanover County Augusta 540 245-5660.

Ways to pay your Council Tax. Real Estate and Personal Property Taxes Online Payment. Premium for empty and unfurnished properties.

What is considered real property. 107 rows Richmonds real estate tax rate is 120 per 100 of assessed value. For information and inquiries regarding amounts levied by other taxing authorities please contact them directly at.

Amelia County 804 561-2158. The approved ordinance will keep the tax rate for real property at 147 cents per 100 of assessed value and raise the tax on personal property to 165 cents per 100 of assessed value. The City of Richmond Commissioners and Mayor Moore adopted the 2020 Tax Rate as well as the 2019- 20 Annual Operating Budget at this weeks monthly Commission meeting.

The median property tax in Richmond City Virginia is 2126 per year for a home worth the median value of 201800. Real property consists of land buildings and attachments to the land andor buildings. 047 2015 not set as of 3315.

Richmond city collects very high property taxes and is among the top 25 of counties in the United States. By the way the City is reporting a deficit in revenue for the coming year. Richmond Council Tax 202223.

Yearly median tax in Richmond City. Council Tax bands and charges. 295 with a minimum of 100.

Read our Guide to Council Tax and Business Rates pdf 28 MB. Energy rebate payments. 79118 Council Tax bands are based on how much the properties would have sold for on 1 April 1991 as.

Richmond City collects on average 105 of a propertys assessed fair market value as property tax.

Dor Town Village And City Taxes

Solving Richmond S Money Problem Richmondmagazine Com

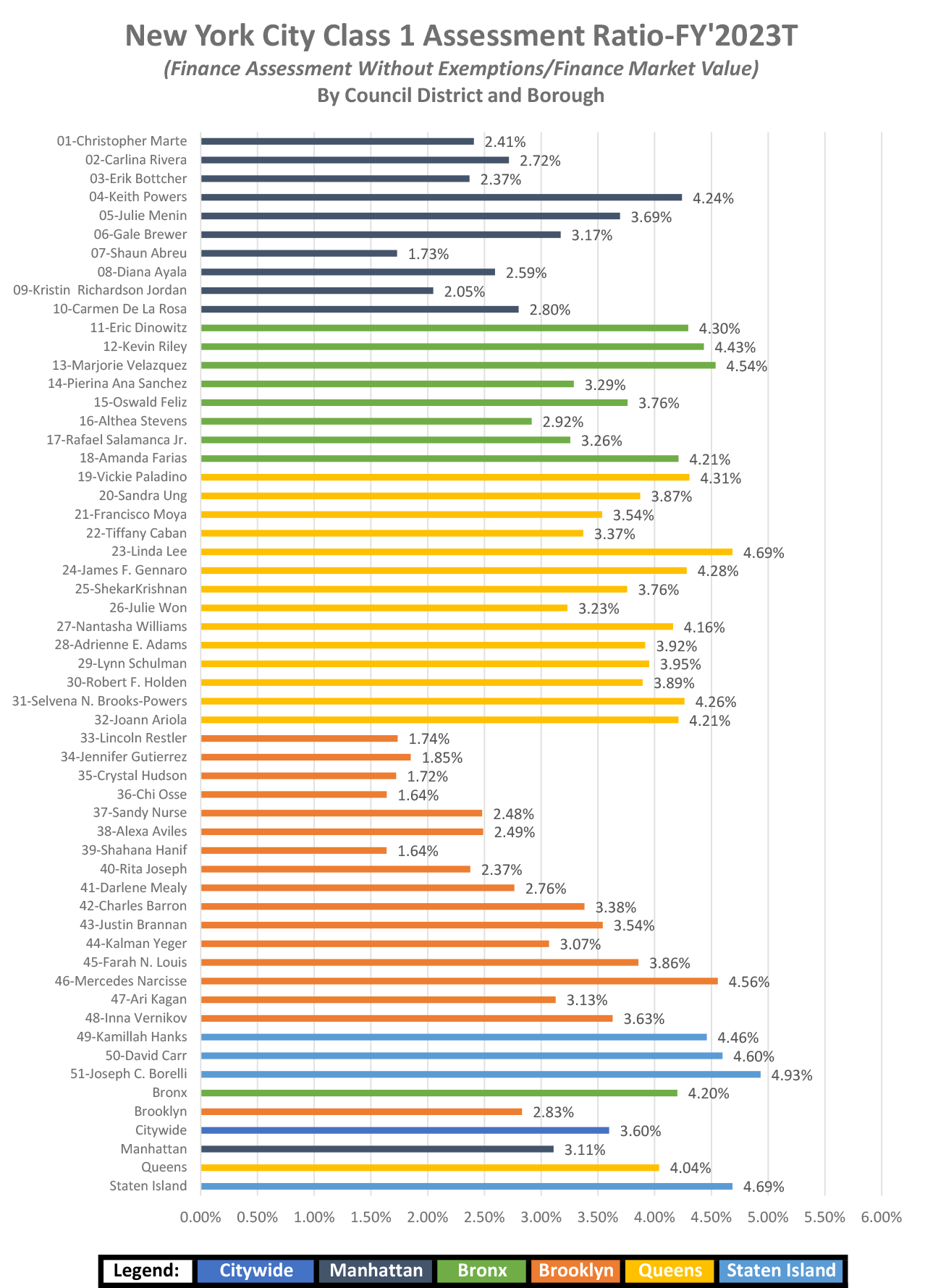

Issue 1 The New York City Property Tax System Discriminates Against Residents Of Majority Minority Neighborhoods Tax Equity Now

Issue 1 The New York City Property Tax System Discriminates Against Residents Of Majority Minority Neighborhoods Tax Equity Now

These Cuyahoga County Places Have Ohio S 6 Highest Property Tax Rates That S Rich Recap Cleveland Com

Richmond Property Tax 2021 Calculator Rates Wowa Ca

New York Buyer Picks Up Northside Apartments Richmond Bizsense Apartment Projects Local Real Estate Commercial Real Estate

Ontario Cities With The Highest Lowest Property Tax Rates October 2022 Nesto Ca

The Leslieville Doll House Looks Like Your Childhood Toy Box Exploded Everywhere Doll House Price Childhood Toys Doll House

New York Property Tax Calculator Smartasset

Issue 1 The New York City Property Tax System Discriminates Against Residents Of Majority Minority Neighborhoods Tax Equity Now

Solving Richmond S Money Problem Richmondmagazine Com

Annual State Of The City S Economy And Finances Office Of The New York City Comptroller Brad Lander